Hi, I’m Rodolphe from Remotive and I have been helping distant firms hire since 2014.

I used to be the COO and CFO at Buffer and paid $8 million a 12 months in salaries to distant team members in over 15 countries. Paying people abroad is my biggest pet peeve!

This guide answers a preferred query from our community:

“Easy methods to legally and simply employ international staff remotely?”

Disclaimer: I’m not a lawyer. My thoughts don’t constitute legal advice. That is just on your information, take it with a pinch of salt. Please do your law homework 🙂

Firms wish to offer one of the best to their distant/international employees.

Most distant firms easily hire international team members as contractors. All they should do is about up recurring payments and… that is it!

Along with compensation, this also makes distant firms less competitive in comparison with a neighborhood employer who can offer full local advantages.

Contractors might also face having to be retrained as employees by the local authority, which might be terrible for them.

Most firms don’t intend to treat international employees as second-class residents, but unfortunately this often happens.

Shows salary, advantages, worker status, breaks, sick time, time beyond regulation pay…

For instance, U.S.-based firms often offer 401k. and medical insurance locally, but not abroad. Does this look familiar?

> What message are you sending to those foreign staff once you treat them in a different way?

Let’s dive in…

Cannot I just hire contractors?

After all you may! That is what most firms do when hiring international team members. They hire contractors and hope for one of the best.

It’s fast and economical. Firms give money to team members, impose hiring as they see fit, and ask their peers to sort out local laws and regulations.

…Nonetheless, this shouldn’t be at all times one of the best solution. Why?

- Your employees want more. Contractors don’t receive the local advantages of employment (think health care, pensions, unemployment advantages, home equity…)

- Your lawyers want more. You should definitely comply with local laws, especially when you may have greater than 5 employees in a given country.

- Your VCs want more. Will you raise funds or sell the corporate in some unspecified time in the future? Employment status can be disclosed during bankers’ due diligence.

So what are your alternatives? You may either:

- Create your individual (local) legal person and hire yourself.

- Conclude a contract with an external company (Record-breaking employeror EOR) to rent you.

Why don’t firms hire everyone as employees somewhat than contractors?

The largest difference between an employment contract and employment are the employer’s social costs.

For instance, in France, employers’ social security is 45-47% plus EOR fees. Yes, that is quite loads! But additionally the conclusion of contracts is strictly regulated and the penalties are quite severe.

You could be asking yourself, what’s the value of an EOR solution then?

Showing you value local employment. Which means that your organization has a robust culture of hiring and retaining employees, constructing a long-term relationship with the worker.

This implies you may’t wait for staff to have full rights and protections under local laws!

Should I start by opening local legal entities?

Plot twist: My default answer isn’t any.

For those who should not a “notable exception” listed below, you should not be starting with a brand new local entity. This is the reason:

Huge distant firms employing over 1,000 people like Automattic and GitLab, even think on establishing local legal entities once they have fewer than 5 individuals in a given country.

Consider it as a long-term commitment. Here’s what GitLab says about it:

“Each country has unique and complicated rules, laws and regulations which will impact our ability to conduct business in addition to the employability of residents of those countries.”

Here’s also Mitchell Hashimoto, CEO of HashiCorp (250 distant first):

“It takes loads of time and loads of money to establish a legal entity: within the last 12 months we now have had at the least one member (more now) in our HR/Finance teams organising legal entities _full-time_. I even have had my signature on at the least 8 founding documents within the last 6 months. By the way in which, most incorporation documents require a “wet” signature, so if you happen to’re distant like us, be prepared to have loads of sensitive legal documents shipped through FedEx.“

Assuming you haven’t got a billion-dollar valuation, a neighborhood corporate entity is probably not your first alternative.

As an alternative, ask yourself these 4 questions:

- timing: How quickly do you search for a world employment solution?

Establishing ONE local entity may take 6-12 months.

- Range/concentration: What number of employees/countries needs to be addressed?

It’s unlikely you will be “value it” if you may have lower than 5 teammates in a given country.

- Compatibility: What’s your risk appetite? Is internalizing/externalizing okay?

Local advice, tax and legal consequences + bureaucracy could make a difference.

- and, after all Budget: How much will you spend here?

Are you authorized to spend 30k-100k? dollars to research this matter?

Also note: :

Opening a neighborhood entity makes you subject to local taxes. Not only employment taxes, but additionally sales taxes. Did that employment in a specific U.S. state makes you subject to sales tax there? The identical applies to most countries. Ask your CFO about it!

Many firms, including Firms using the US-SaaS service approach this topic VERY fastidiously. For instance, opening a totally latest entity in continental Europe power whether you might be required to charge European VAT on local payments you collect.

Finally, you will have a neighborhood lawyer, possibly your health bank balance and a physical address…

Noteworthy exception:

- If you may have 5-10 people working in a rustic with easy laws (say Canada, UK, Ireland, Singapore…), opening a neighborhood entity could also be an obvious solution.

- For those who’re fascinated by opening a brand new market with a physical office, you would possibly want to think about organising a store.

Easy methods to legally and simply employ international staff remotely?

Hiring people out of the country shouldn’t be a brand new problem. This has been happening for a while, many firms are solving this problem today:

They’re called Record-breaking employeror EOR: a company that assumes obligation for hiring your employees. Some (not all) take care of pay/advantages. The term “PEO” (Skilled Employer Organization) can also be often used.

Let’s zoom out for a moment. Most international distant firms fall into one in all 4 tiers:

- Level 1: Mixture of local employees and independent contractors.

Examples: Almost every distant startup that gets began.

- Level 2: Mixture of local employees, independent contractors and EOR.

Examples: frontal.

- Level 3: A mixture of local staff, independent contractors, EORs and staff through their very own entities.

Examples: ShieldGeo, Buffer.

- Level 4: Most employees through their very own entities (national + local), some EOR and contractors.

Examples: Automattic, GitLab, most FANG firms…

Let’s speak about EOR…

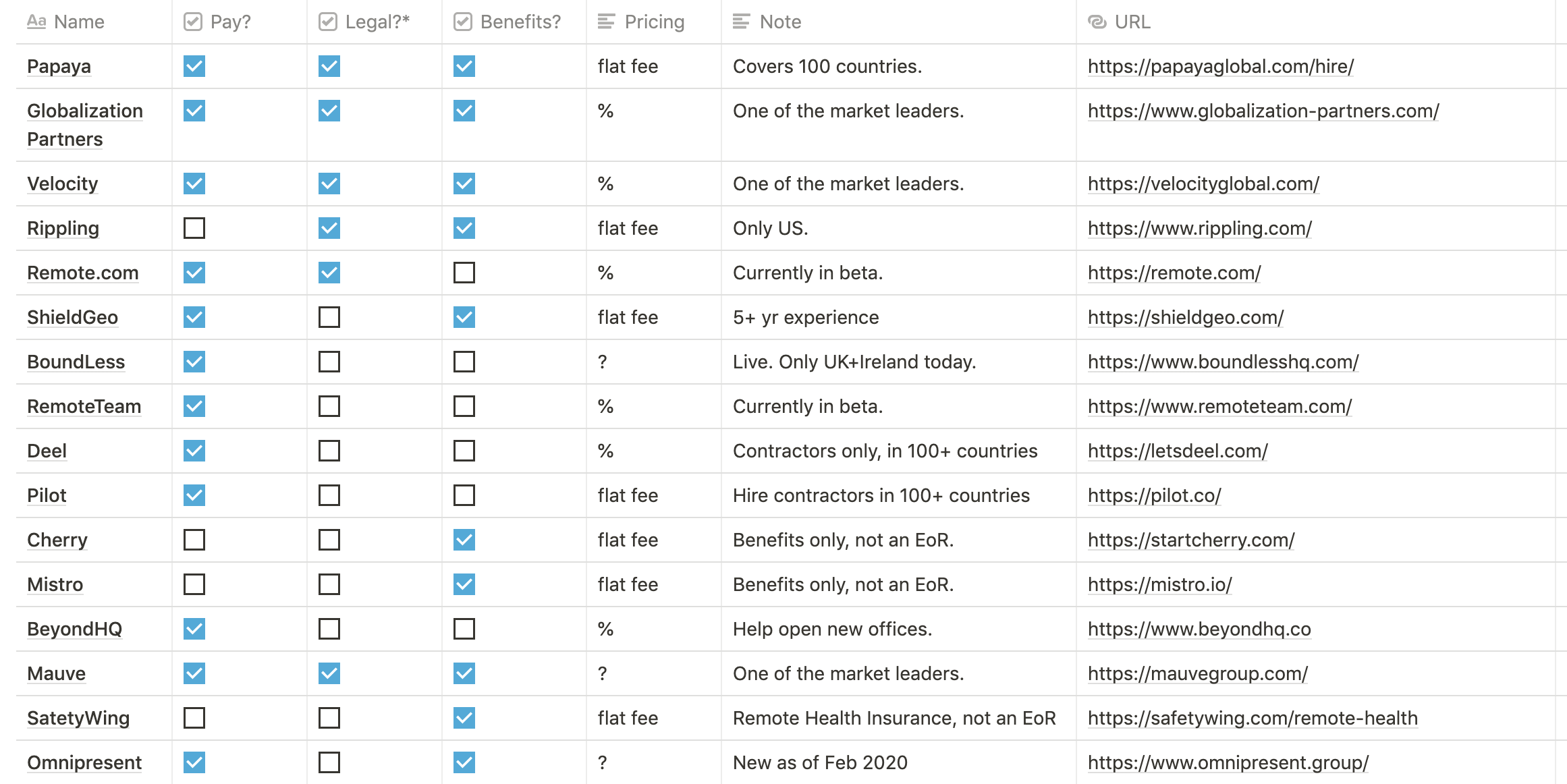

While that is an old problem, a brand new wave of EOR/service providers have emerged over the past five years. They wish to facilitate employment abroad!

Most of them support multiple countries and carry (some) risk, so that you maintain local compliance. Why only “some” risk? Each EOR covers you in a different way, it is advisable to read the effective print. For instance, local endings might be hairy, they assist you navigate.

Most of them support:

- Local compliance and formalities.

- Access to local experts.

- Offer local advantages.

- Payroll process.

Other notable firms include: Just Payroll Services (UK only), TMF Group, Safeguard, CXC, Elements Global Services…

My general advice…

Here is my general rule, spread throughout our community:

- Hiring people of various nationalities outweighs the complexity of all of it.

- Fair is fair. Align local/international advantages and perks every time possible.

- Hiring people as contractors is approach to start.

- Switching to EOR is best for legal reasons if you happen to can afford it.

- Only arrange a legal entity if you may have multiple employees in 1 country and sufficient funds to cover legal/operating fees. Watch out for tax and accounting consequences.

- EU firms employment within the EU, there are some exceptions. For instance FR<>DE and FR<>UK. Many examples from the European Economic Area (EEA).

- American firmsemployment shouldn’t be possible in countries subject to US sanctions: Iran, North Korea, Crimea, Syria, Sudan, Cuba.

- Some countries have notoriously complicated local labor laws, e.g. France, Italy, Germany…

- Here’s an excellent law firm perspective on the subject hiring independent contractors.

- This HN thread is probably the greatest articles on the topic: “I am the founder of a company employing about 250 people, primarily remote ones..

What’s next?

- Have questions? Might be joyful to assist. Text me! (“rodolphe” on remotive.com).